Create Your Account

Sign up in minutes and start sending money worldwide with ease, security, and speed.

Sign up in minutes and start sending money worldwide with ease, security, and speed.

Sign up in minutes and start sending money worldwide with ease, security, and speed.

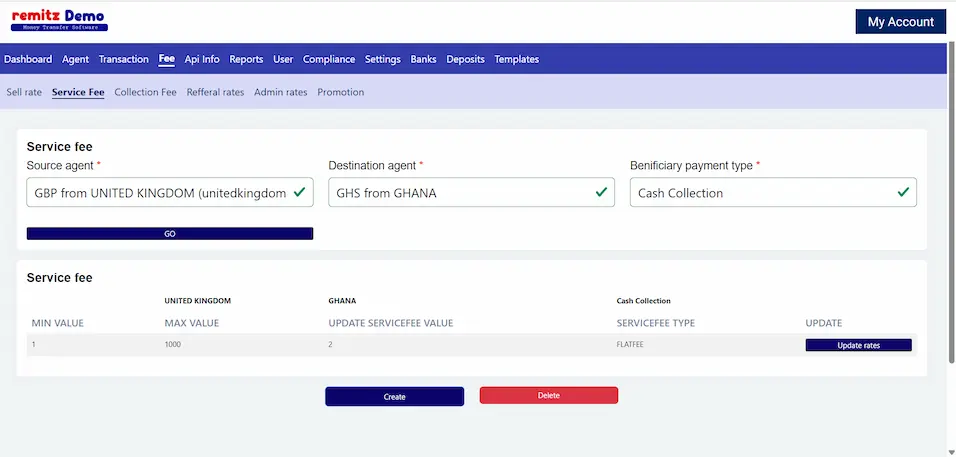

The service fee can be set here based on the corridors. The service fee here can be set in such a way that it be set as a percentagw fee or flat fee.

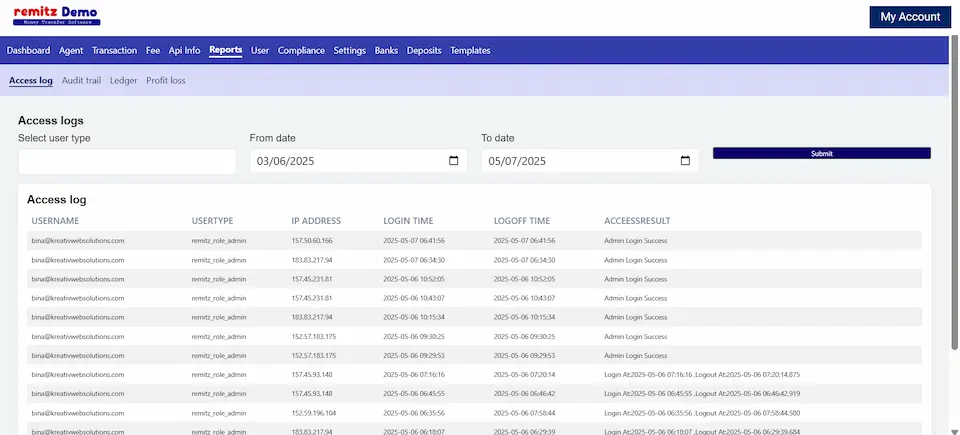

Here we will be able to see when and from what ip address any person who is registered on the software is logging in. this included even the staff members with different roles.

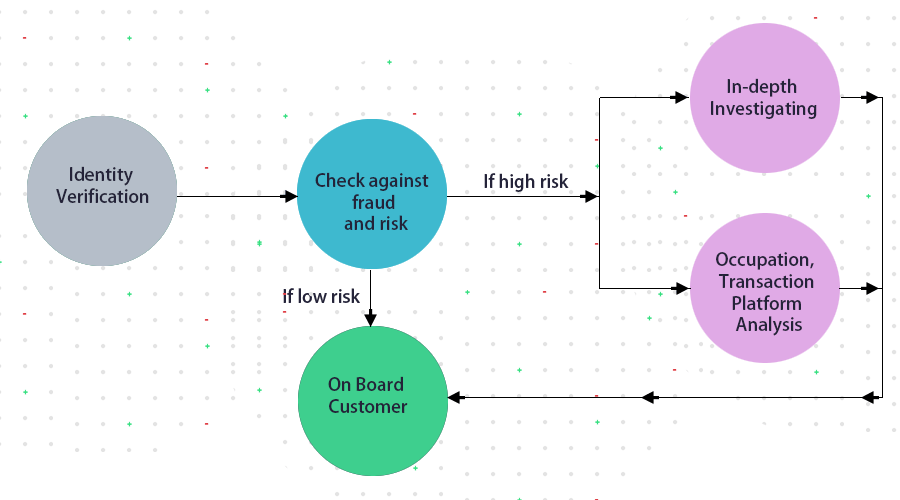

These are the rules set up in the software according to the AML of a sending country. when these rules are effective, the transactions are flagged here and sent for approval to the compliance role.

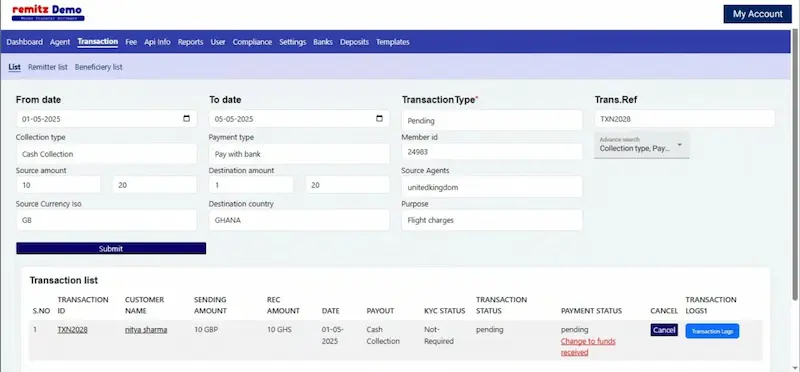

The list of all transactions done by customers and also by agents will be listed here. The transaction list helps remittance businesses manage and track all transactions efficiently.

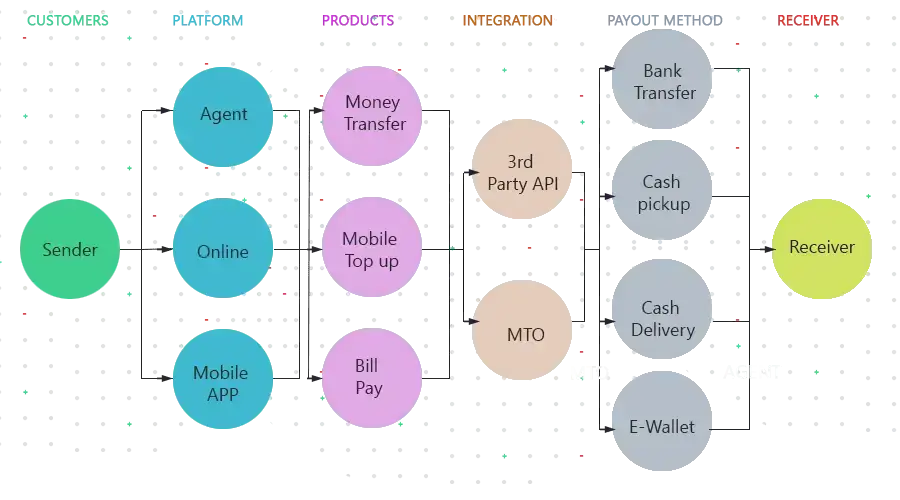

In today’s fast-paced financial landscape, running a successful money transfer business requires cutting-edge technology and seamless operations. At Remitz, we provide a robust money transfer software solution designed to streamline your remittance processes, enhance customer satisfaction, and boost your business growth. Our remittance software features are tailored to meet the unique needs of your money transfer business, ensuring efficiency, security, and scalability.

Whether you’re a small-scale operation or a large-scale facility, our money transfer platform removes complexity and delivers trusted solutions. Our money transfer software integrates various payment methods, including card payments, bank transfers, and mobile wallets, to enhance user experience and ensure smooth transaction processing. Adhering to Anti-Money Laundering (AML) regulations is crucial, and our platform ensures secure and compliant transactions.

With our online money transfer service, you can rapidly grow transaction volumes. Customers can easily and securely transfer funds online through quick registrations via mobile or laptop browsers, complete with KYC and AML compliance checks. Our cloud-based money transfer software transforms your business by offering integration, web enhancements, and brand elements. The ability to transact from home enhances customer satisfaction, and remitters can create their own set of beneficiaries and transactions.

Our agent-based money transfer software allows transactions to be conducted over the counter. The cloud-based money transfer platform provides smart technology that overcomes hurdles, enabling easy transactions from agent locations and precise monitoring of agents and their accounts. This solution transforms your money transfer business, enhancing customer convenience while ensuring KYC and AML compliance.

Our money transfer software solution enforces rules in real-time, seamlessly incorporating critical components like business and AML rules, along with KYC verification. Key features include:

Our money transfer software solution offers stunning user interfaces for an exceptional customer experience. Agents can upload, create, edit, and retrieve infinite customer details with ease, including:

Simplify and streamline your reporting with Remitz. Our money transfer software solution helps you better understand and improve operations and customer relationships through:

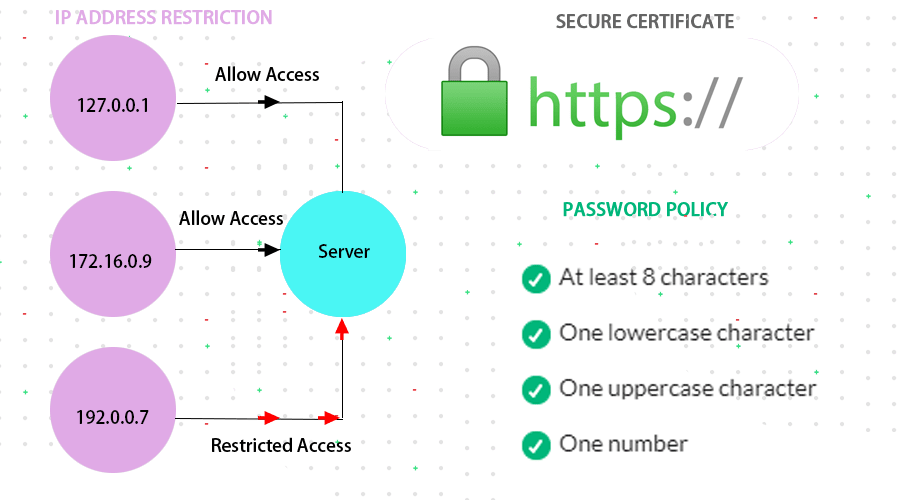

Security is a top priority for your money transfer business. Our platform provides robust and reliable security features, including:

Our money transfer software is accessible from anywhere using our mobile apps for Android and iOS, as well as all popular web browsers. This ensures flexibility and convenience for both you and your customers.

Our experienced technical experts provide extended support to help you optimize the use of our money transfer software solution. We offer:

Our platform simplifies user creation and management with features like:

Efficiently manage fees and exchange rates with our money transfer software:

Customize your platform to fit your money transfer business needs:

Our platform provides comprehensive reporting and compliance tools:

Efficiently manage all transactions with our money transfer software:

Our platform simplifies setup and agent management:

The remitters also get to create their own set of beneficiaries and transactions.

Stay compliant with Compliance, AML, and KYC

A tailored solution to truly fit your needs and seamlessly incorporate critical components like the enforcement of your business and AML rules, with KYC verification throughout your operation

Usage made easy

The software allows the agents to upload, create, edit, and retrieve infinite customer details within no time in easy steps, including the creation and management of customer accounts as a key feature.

Data Management, Reporting & Analytics

Simplify and Streamline your reporting with Remitz. we help our customers to better understand and improve their operations and customer relationships.

Secure your Website/Portal and Data

Robust and Reliable security is provided to ensure the higher level encryption for transactions is done so that they cannot be misused or tampered with

Access anywhere

Access remitz.co.uk anywhere using our mobile apps for Android and iOS

Unparalleled technical support

Our experienced technical expertsextended support for the remitz software to help you optimize the use of our software solutions or customize the system so that it enhances your business needs and requirements.

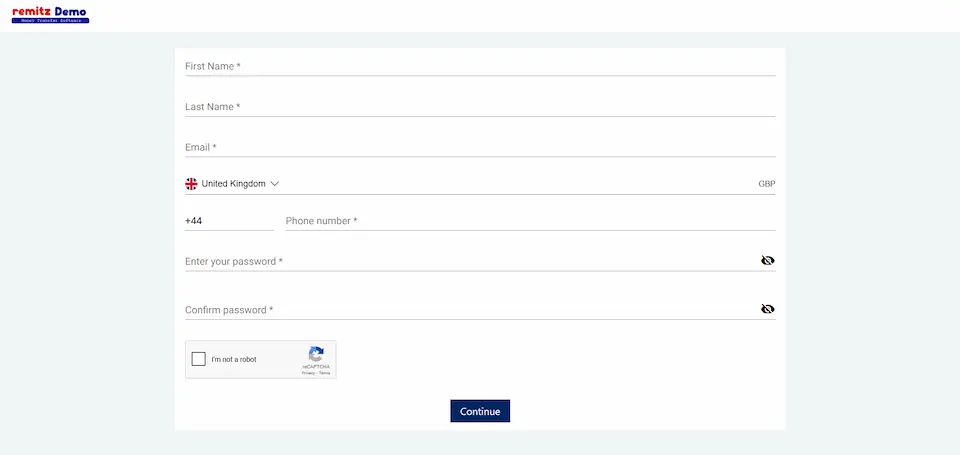

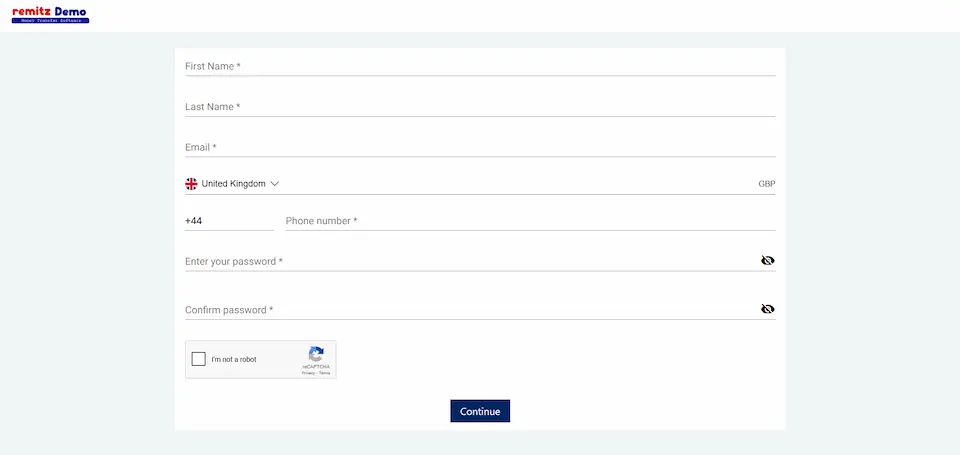

User will be registered with minimum fields.

When a customer is registered the customer will be sent an OTP and email will be verified.

When a customer is registered the customer will be sent an OTP and the mobile number of the customer will be verified.

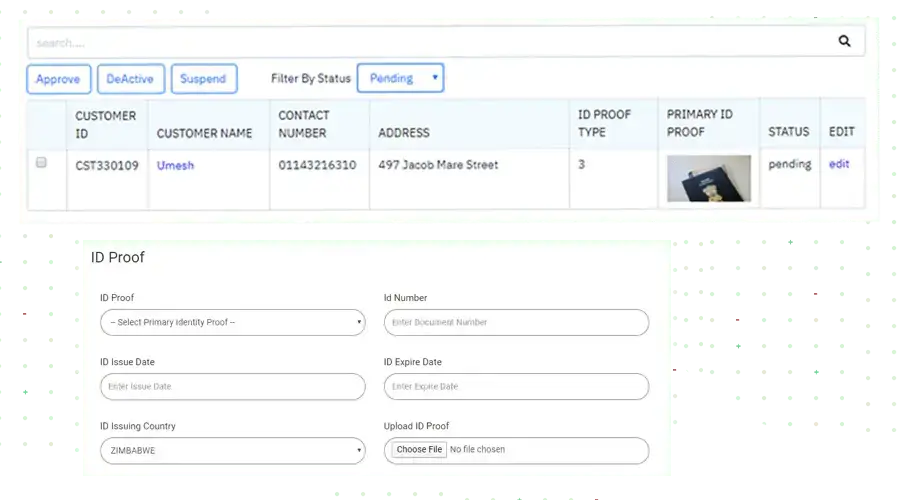

Upon customer registration, the customer needs to create and manage customer accounts by entering full personal details, including identity documents and address proof documents. These details are stored on the computer and used to do KYC for the customer.

After the customer is registered on the system, identity and address proof documents are available on the admin panel of the system. On varification of these documents KYC approval of done.

All the customers registered on the system will be available here, the customers.

All the customers registered on the system.

When a user login to the account, he needs to enter the OTP received on his mobile device to login. This is the security we have on the system.

The service fee can be set here based on the corridors. The service fee here can be set in such a way that it be set as a percentage fee or flat fee.

The collection fee can be set here based on the corridors. The collection fee will be influenced by real-time exchange rates and the payment type the customer is using while making a transaction, including various payment methods like card payments, bank transfers, and mobile wallets.

User will be registered with minimum fields.

User will be registered with minimum fields.

The service fee can be set here based on the corridors. The service fee here can be set in such a way that it be set as a percentagw fee or flat fee.

The collection fee can be set based on the corridors and will depend on the customer's payment method during the transaction.

Whenever an admin wants to give promotions to customers. admin can set the promotions here.

Admin can create a new login here, every login will have a different type of role. and the new user can login with the role assigned.

The list will be available here, admin can edit or add a new list here.

The list will be available here, admin can edit or add a new list here.

The list will be available here, admin can edit or add a new list here.

Integrating with local service providers can enhance various payment options, such as utility bill payments and mobile top-ups. Banks for all receive countries can be added here, so that when a bank deposit is selected for any receiving country and that bank will be visible for the customer.

Here we will be able to see when and from what ip address any person who is registered on the software is logging in. this included even the staff members with different roles.

Here the data visible is any staff member who has edited any information of the customer, we will track when and from whose login or ip address the staff has accessed or edited this information.

Here the ledger is for any particular agent, allowing for the management of transactions in multiple currencies. We can see the balance here.

Profit and loss for that agent who is logged in will be visible here

When agents make transactions, some part of the agent's collections needs to be deposited to admin or receiving agents. After depositing the entries are made from here and sent for approvel.

After the agents deposit, the list is displayed with respective agents and then approved here. after the approval, it will be added to ledger.

These are the rules set up in the software according to the AML of a sending country. when these rules are effective, the transactions are flagged here and sent for approval to the compliance role.

This is the limit for any sending country above which the id proof is mandatory.

This is again for the use of AML, which is displayed in compliance roles, by seeing officer will approve any transaction to flow through the process.

New branch here means a new country and whenever an agent wants to start from a new country, they can create a new one.

The new branch created will be listed here.

The agents will be created under a branch, nothing but a country, that agent can be a send or receive agent or bot send and receive agents. the send agent can make transactions and the receive agents can payout any transaction made by send agents.

All the send and receive agents will be listed here

Mapping is done here so as to map the send agent with the receiving agent. when a send agent is selected only the mapped receiving agents will be visible.

The software charges a service fee and that service fee can be distributed among send agent, receive agent and admin. the percentage share will be visible here. based on this when a transaction is made we will calculate the revenue and store it in respected tables. after which they can be easily retrieved and shown in profit and loss.

For every receiving agent, the money transfer system integrates various payment methods to provide secure and accessible money transfer services, including card payments, bank transfers, mobile wallets, bank deposit, cash collection, and mobile money or airtime top up. These can be enabled or disabled here.

Here the percentange is allocated for profit in exchange rate profit and the same will be distrubuted among them.

The list of all transactions done by customers and also by agents will be listed here.

The transaction list helps remittance businesses manage and track all transactions efficiently.

Here the transactions can be filtered based on the date, type of transaction refrence no. and some advanced features.

A copy of all transaction will be downloaded here in CSV format

A copy of all the transactions will be downloaded in pdf format

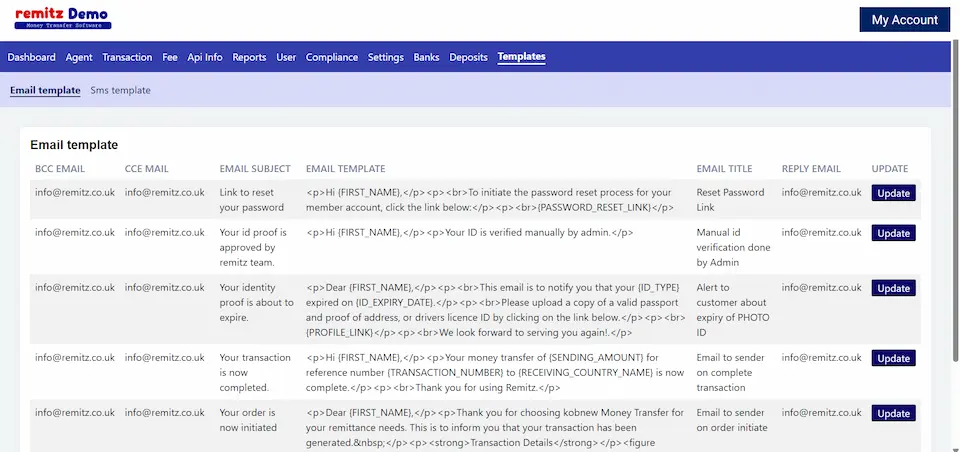

Any API can be integrated here, including email, SMS, and payout APIs, to enable transfers between different payment methods through API integration.

The in-house API is for Remitz software, which can be given to any integrate their software to Remitz software